tax credit community meaning

Web The number of California filers who received the Young Child Tax Credit declined to 420000 in 2020 from 430000 in 2019. Web The Low-Income Housing Tax Credit provides a tax incentive to construct or rehabilitate affordable rental housing for low-income households.

Correct answer A tax credit property is an apartment complex or housing project owned by a landlord who.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675308/GettyImages_1233580576.jpg)

. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. The credit can be in the form of a rebate or a direct reduction. Web A tax credit is an incentive provided to the taxpayers by the government effectively reducing the total tax paid.

A nominated tract had to meet one of the criteria under the. Web The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax. Web Opportunity Zones are census tracts that are economically-distressed communities where new investments may under certain conditions be eligible for.

Treasury in April 2018. Web Opportunity Zones were nominated by state governors and certified by the Secretary of the US. Web What Is a Tax Credit.

Web The California Earned Income Tax Credit CalEITC and the Young Child Tax Credit YCTC are state tax credits for working Californians. An amount of money that. If you qualify you may see a reduced tax bill.

The Low-Income Housing Tax. Web Correct answer What Is A Tax Credit Community. Web Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to.

Those credits are for Californians who. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants. An amount of money that is taken off the amount of tax you must pay 2.

Web Community Tax Credit Empowered Giving Community Tuition Grant Organization To provide low-income families with tuition assistance and to offset the cost of tuition for. Web The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant. Web The New Markets Tax Credit NMTC was established in 2000.

A tax credit differs from deductions and exemptions which. Web Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to. Noun an amount of money that is subtracted from taxes owed.

Web tax credit definition.

Earned Income Credit Eitc Definition Who Qualifies Nerdwallet

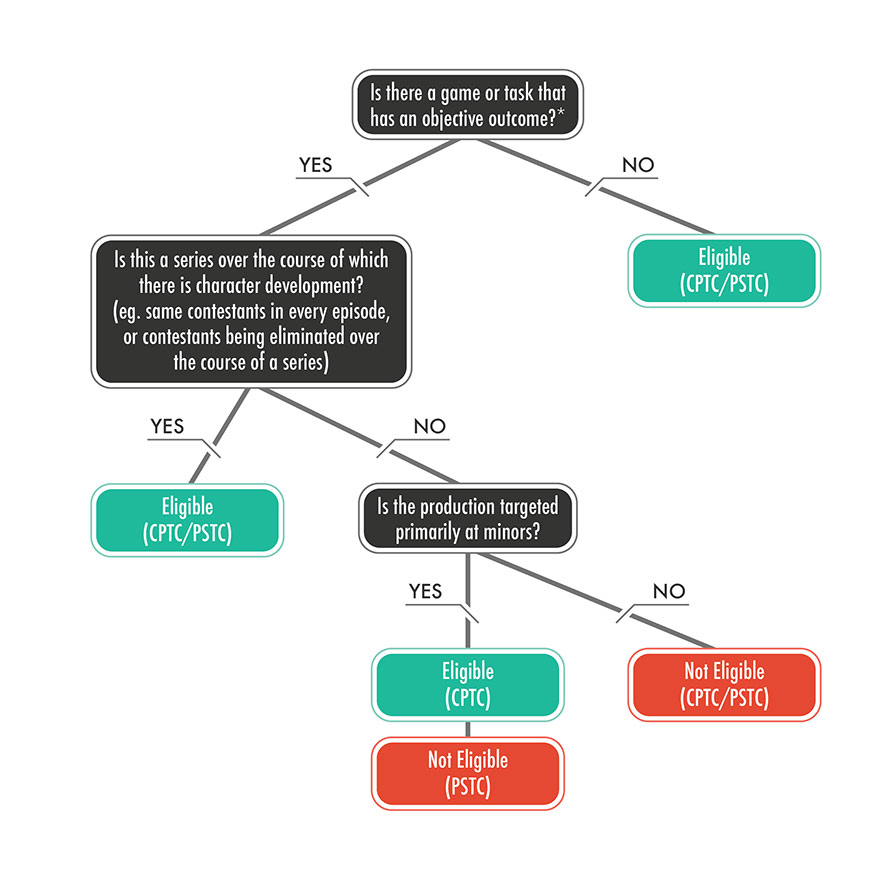

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

A Simple Guide To The R D Tax Credit Bench Accounting

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Home Renovation Tax Credits In Canada Wowa Ca

What Are Tax Credits Turbotax Tax Tips Videos

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

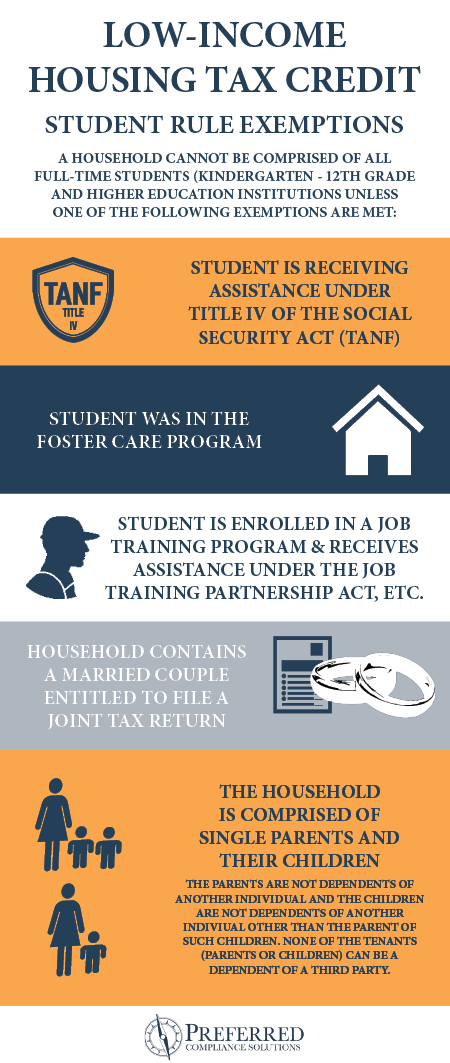

What Are Student Rule Restrictions For Affordable Housing

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Ontario Film Television Tax Credit Ofttc

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675308/GettyImages_1233580576.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

:max_bytes(150000):strip_icc()/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)