nevada estate and inheritance tax

Inheritance taxes are paid by the person receiving the money or. Nevada also does not have a local estate tax.

Nevada Income Tax Calculator Smartasset

Ad Instant Download and Complete your Probate Forms Start Now.

. No estate tax or inheritance tax. Inheritance tax of up to 16 percent. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Estate taxes are levied on the total value of a decedents. Under Nevada law there are no inheritance or estate taxes.

The beneficiary who receives the. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax. Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an.

It is one of the 38 states that does not apply an estate tax. No estate tax or inheritance tax. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax.

Inheritance tax of up to 18 percent. However an estate in Nevada is still subject to federal inheritance tax. Thats why Nevada is such a.

Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is. Nevada does not impose an inheritance tax. Nevada gift tax and inheritance tax planning.

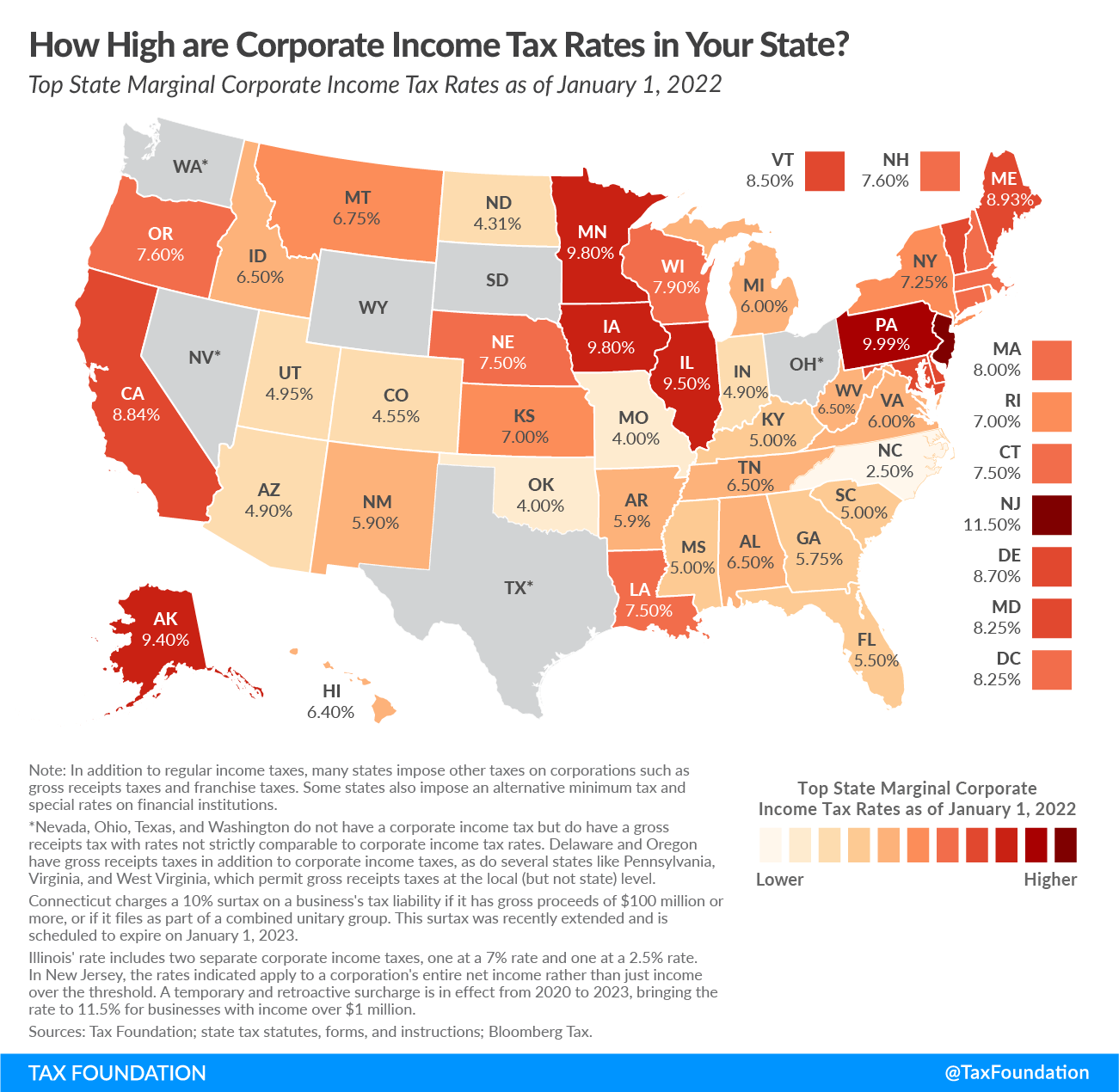

The probate process is not required in Nevada if the decedent has set up a trust or family trust which in most cases helps their estate to avoid probate. The estate tax rate was adjusted so that the first dollars are taxed at a 9. Eight states and the District of Columbia are next with a top rate of 16 percent.

Select Popular Legal Forms Packages of Any Category. Nevada Inheritance Tax and Estate Tax. Does Nevada Have an Inheritance Tax or Estate Tax.

However if those trusts or plans were. Basically the difference between inheritance taxes and estate taxes is who is responsible for paying. In 2021 the first 117mil per individual is.

Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. All Major Categories Covered. NV does not have state inheritance tax.

Estate tax of 306 percent to 16 percent for estates above 59 million. An estate that exceeds the Federal Estate Tax Exemption of 1206. The difference between inheritance and estate tax is a matter of who is responsible for paying the tax.

But your inheritance can still become subject to federal estate taxation. Nevada imposes an estate tax equal to the maximum credit allowed under the federal tax code for paid state estate and. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut.

Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate. No estate tax or inheritance tax.

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada State Taxes Everything You Need To Know Gobankingrates

Nevada Tax Advantages Luxury Real Estate Advisors

Estates And Trust Services Tax Lawyer Inheritance Tax Divorce Attorney

The Key Estate Planning Developments Of 2021 Wealth Management

Historical Nevada Tax Policy Information Ballotpedia

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Nevada Tax Rates And Benefits Living In Nevada Saves Money

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

The 10 Happiest States In America States In America Wyoming America

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Advantage Trust Services Whittier Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Tax Advantages And Benefits Retirebetternow Com